Aligning Leaders and Systems Around What Matters Most

Pacific National plays a critical role in Australia’s supply chain. But like many organisations shaped by strong engineering and operational cultures, they found themselves struggling to connect their business strategy with what their customers actually needed.

With internal momentum building for change, Pacific National asked Proto to help them develop a unified cx strategy and design approach that would create clarity, drive alignment across senior leadership and embed customer priorities into commercial decision-making.

This wasn’t about softening the business; it was about sharpening its focus.

A Legacy Business at a Strategic Crossroads

After years of growth, Pacific National had become the backbone of Australia’s intermodal freight operations, but with that growth came complexity. Teams across the business were working hard, but not always together. Customer challenges were often seen as operational issues, rather than strategic opportunities. And while the business had launched transformation efforts before, few had delivered lasting internal alignment or meaningful change for customers.

Executives agreed something had to shift. But what? And where would they begin? That’s where we came in.

From Commercial Intent to Customer Impact

Our first task was to bring leaders together around a shared understanding of their customer and around a shared language for discussing customer needs, behaviours, and priorities. The insight was clear: everyone cared about the customer, but few had a reliable way to talk about them with specificity and confidence.

We designed a multi-stage executive alignment program to:

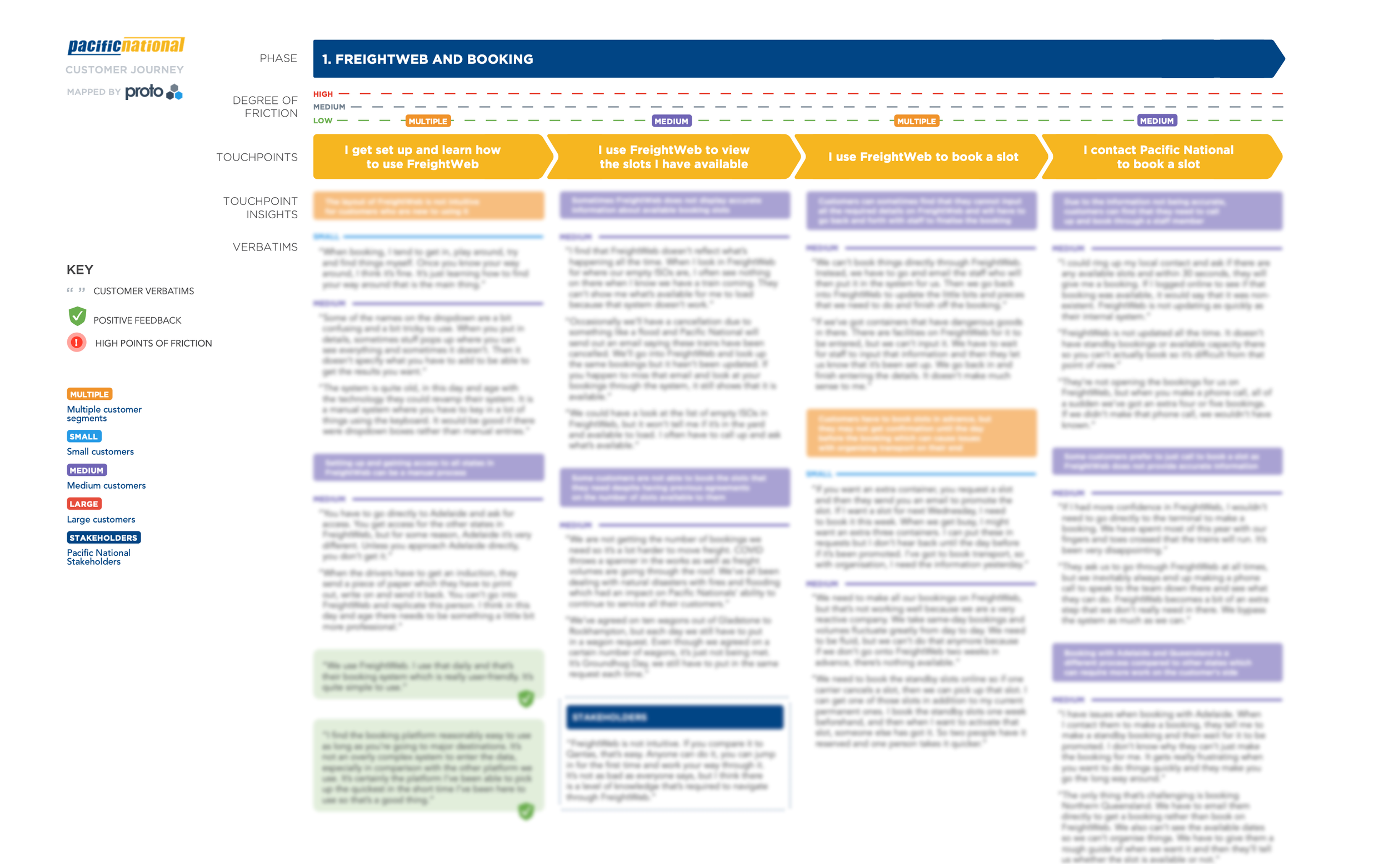

Map the disconnect between strategy and customer delivery

Uncover critical pain points and effort drivers

Build the internal case for investment in CX

Introduce a clear and practical customer segmentation model

We worked closely with senior leaders in strategy, commercial, operations, marketing and digital to ensure the new cx strategy and design approach would be built into the business, not bolted on.

Building the Foundation: Moments That Matter

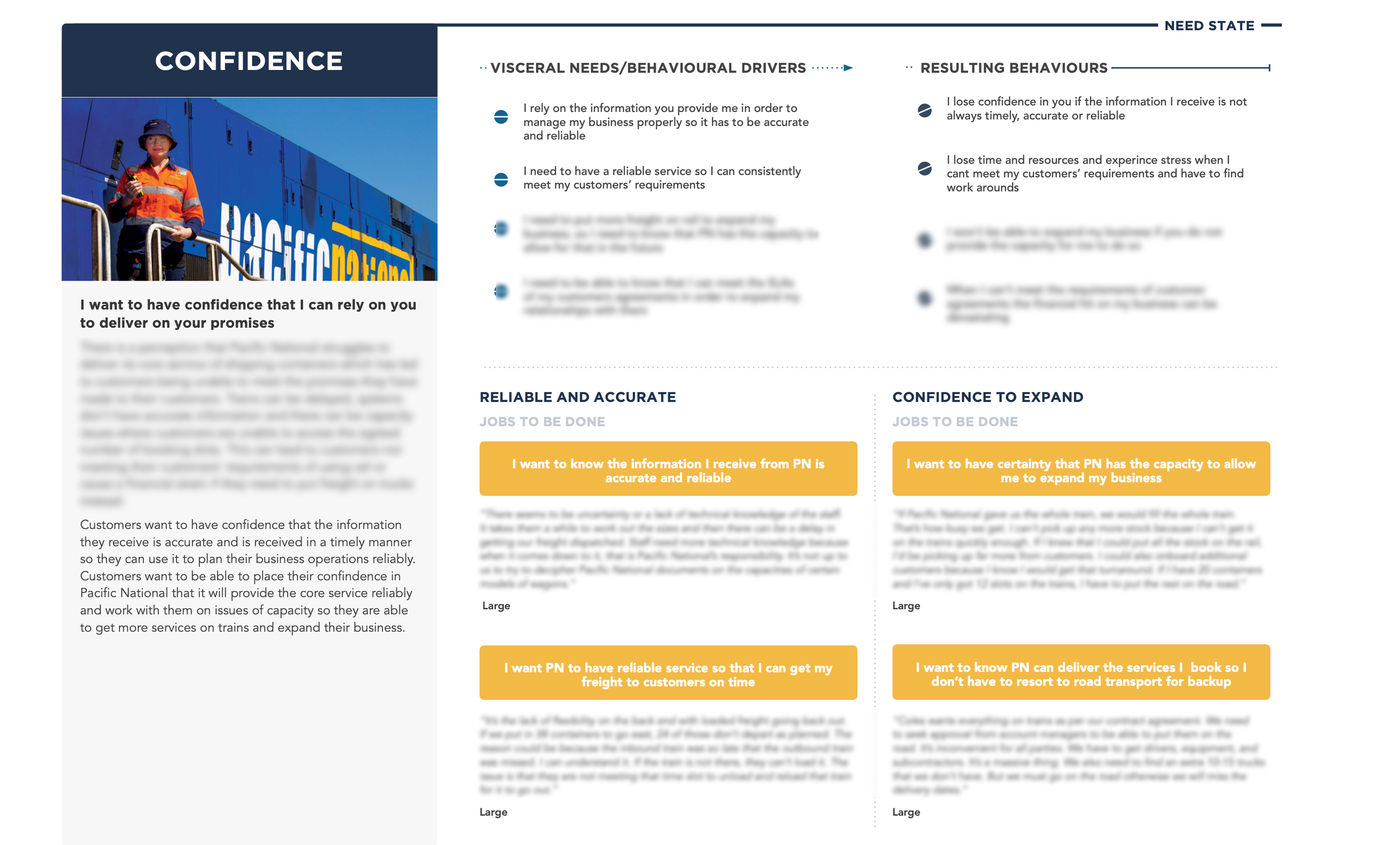

Our research quickly revealed that Pacific National’s customers were far from uniform. What worked for a high-volume retail logistics partner didn’t necessarily work for a smaller regional customer or a customer moving dangerous goods.

We introduced a customer segmentation model that clarified:

Who the key customer groups really were

What jobs they were hiring Pacific National to do

Where expectations and delivery were misaligned

Which moments truly mattered in their journey

This wasn’t just some marketing exercise, it became the backbone of a new, commercially integrated Business approach.

Turning Insight Into Executive Action

With segments defined and core needs understood, we facilitated a series of working sessions with the executive team to:

Prioritise initiatives that aligned with customer value and business impact

Reframe legacy internal programs through a CX lens

Design governance models that would support long-term CX maturity

Create customer-led investment criteria to inform major business decisions

At every stage, the focus was on pragmatic progress: what’s the next best decision we can make that moves us closer to a connected, customer-led business

A Strategy Designed to Stick

The final CX framework was not delivered as a “playbook” that would gather dust. It was built into the rhythm of the business, embedded in cross-functional steering groups, and designed to grow in line with Pacific National’s internal capabilities over time.

Our work gave the executive team:

A shared vocabulary and strategic filter for all customer conversations

A clear, actionable segmentation model linked to journey stages and business priorities

A governance structure to support investment, measurement and momentum

The confidence to move forward with a strategy they owned — not one imposed from outside

CX Strategy That Moves With the Business

Pacific National didn’t just need a new strategy; they needed a way to connect commercial logic with customer truth. Our approach to customer strategy and design gave them a clear path forward, grounded in real needs, endorsed by their senior leaders, and tailored to meet the unique demands of the freight and logistics sector.

It's not always easy to create alignment in a business this large, complex, and operationally focused, but with the right insights, the proper structure and the right level of buy-in, meaningful change becomes not only possible but also sustainable.