What can a Customer Insight agency teach a fintech?

As a customer insight agency, we worked closely with our client to really understand the emotional blockers and decision-making patterns around investing. By uncovering the hidden drivers behind hesitation, we helped them design a service offer that removed the doubt, worry, and sleepless nights that often come with financial decision-making. Not surprisingly, it took off.

Your customers' needs are always changing, your approach should too

Investing in the future has never been more critical — but confidence in the financial sector has never been lower.

We partnered with Bell Direct, a forward-thinking financial services brand that saw an untapped segment: middle-income professionals who had the capital, but not the confidence, to use smart investing as a path to long-term wealth.

They already had the product. But without trust, clarity, and emotional buy-in, the service would never reach its potential.

They needed to understand what was holding people back. And they needed a customer insight agency that could turn emotional complexity into actionable clarity.

Letting the Customer Define the Issues

The first step in any meaningful service design process, especially in finance, is to stop talking and start listening.

We began by reviewing all available customer data and speaking with key internal stakeholders. From there, we expanded our lens through direct qualitative interviews with customers, NPS research, and targeted problem interviews that explored emotional blockers in-depth.

As a customer insight consultancy, our role is to ensure that real problems surface, not just the obvious ones.

Illuminating the Blockers So We Can Erase Them

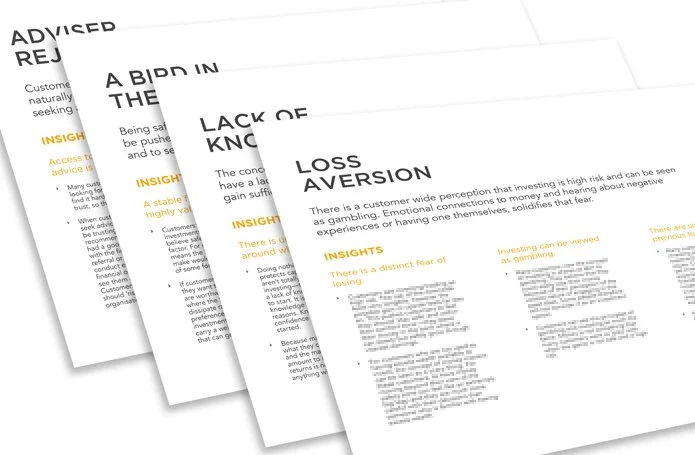

Through this discovery work, four emotional and behavioural themes emerged:

Loss aversion - the fear of losing money was stronger than the reward of potential gains

Skillset insecurity - customers didn’t feel they had the knowledge to invest confidently

Distrust in experts - low faith in financial planners undermined advice

The safety illusion - saving felt safer, even if it meant lower long-term returns

Our job as a customer insight agency wasn’t just to observe these blockers — it was to help the business solve them.

Better Services for Everyone

With our insight-led product design and redesigned journey, the platform shifted from ‘good idea’ to market leader.

Customers reported feeling more confident and in control. More importantly, they acted on that confidence — investing more, staying longer, and referring others.

By embedding deep customer insight into the service’s DNA, our client created growth that was both meaningful and sustainable.

See What Customer Insight Could Unlock in Your Business

We don’t just run research. We turn human understanding into strategic fuel - then help you build the service that proves you’re listening.

If you’re ready to grow through insight, let’s talk.